Photo by Scott Graham on Unsplash

Net Present Value 101

What is Net Present Value?

One of the things I've learnt about working in investing and finance is the concept of "Net present value". This is a way for investors to evaulate across multiple years the value of long term investments.

To understand NPV, you need to do some math to calculate the "Present Value" of each round of returns (Future Value). This is because capital ("money") has different value today in your hands versus promised tomorrow. Money today is worth more as it can be used or invested. Once invested, it requires time to build up interest.

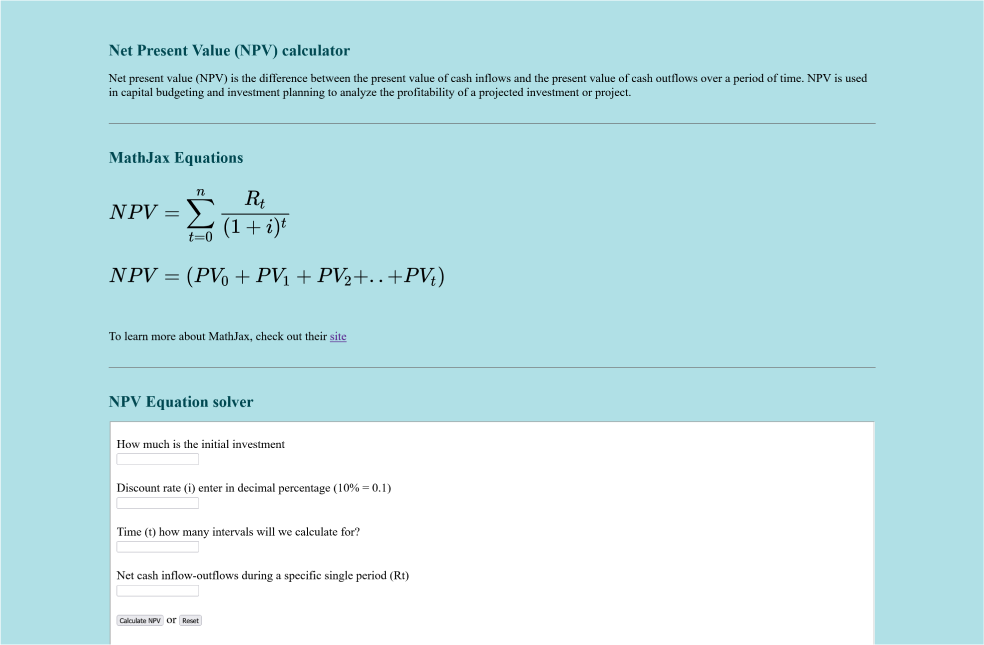

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project.

― Jason Fernando

NPV is the result of calculations that find the current value of a future stream of payments using the proper discount rate. In general, projects with a positive NPV are worth undertaking, while those with a negative NPV are not.”

Net Present Value (NPV): What It Means and Steps to Calculate It

Updated May 24, 2023

How to calculate NPV

The first thing to understand is what we mean by "Present Value". Present value is the value of future returns adjusted to

the value today. It's important to understand that money we have in our pocket today is worth

Question: How much money would I have in 1 year if I invest $100 at with an expected return of 10% per year?

$$ {$100 \times 1.1 = \color{red}{$110}}$$ $$ {PV \times (1 + i) = FV}$$$110 would be the Future Value of my investment

Question: How much money would I have would I have to invest at an expected return of 10% per year to end up with $110?

$$ {$110 / 1.1 = \color{red}{$100}}$$ $$ {FV / (1 + i) = PV}$$$100 would be the Present Value of that investment

Now let's try out this formula for 2 years. With the second year, the amount of return would compound. Meaning that we start the second year with more than $100 base, we also have the $10 that we had earned at the end of the first year.

Question: How much money would I have in 2 year if I invest $100 at with an expected return of 10% per year?

$$ {$100 \times 1.1 \to $110 \times 1.1 = \color{red}{$121}}$$ $$ {PV \times (1 + i) = FV}$$$121 would be the Future Value of my investment

Question: How much money would I have would I have to invest for 2 year at an expected return of 10% per year to end up with $121?

$$ {$121 / 1.1 \to $110 / 1.1 = \color{red}{$100}}$$ $$ {FV / (1 + i) = PV}$$$100 would be the Present Value of that investment

Now for something more challenging, let's look a the NET Present Value of an investment over 4 years. The NET present value is to calculate the overall value of an investment with consideration of the inital cost. If the NPV is positive, then it's worth it, if it's negative then it won't be a good investment.

Starting off with an investment that costs $1000 today, and will pay back $400 every year for 4 years. We'll assume that the WACC (Weight average cost of capital) is 20%.

| Today (Present Value) | Year 1 (Future) | Year 2 (Future) | Year 3 (Future) | Year 4 (Future) | |

|---|---|---|---|---|---|

| Benefit | $400 | ||||

| Benefit | $400 | ||||

| Benefit | $400 | ||||

| Benefit | $400 | ||||

| investment (inital cost) | (-$1000) |

By applying the previous forumal for Present value ...

Forumla

$$ {FV / (1 + i)^t = PV}$$Year 1 returns

$$ {$400 / 1.2^1= \color{red}{$333}}$$$333 would be the Present Value for year 1

Year 2 returns

$$ {$400 / 1.2^2= \color{red}{$278}}$$$278 would be the Present Value for year 2

Year 3 returns

$$ {$400 / 1.2^3= \color{red}{$231}}$$$231 would be the Present Value for year 3

Year 4 returns

$$ {$400 / 1.2^4= \color{red}{$193}}$$$193 would be the Present Value for year 4

And plugging the Present value numbers back into the table..

| Today (Present Value) | Year 1 (Future) | Year 2 (Future) | Year 3 (Future) | Year 4 (Future) | |

|---|---|---|---|---|---|

| Benefit | $333 | $400 | |||

| Benefit | $278 | $400 | |||

| Benefit | $231 | $400 | |||

| Benefit | $193 | $400 | |||

| investment (inital cost) | (-$1000) |

Now let's sum up all the Present values to get the NPV..

Since the NPV is POSITIVE based on the WACC used, we can confirm that this is an investment worthwhile that will beat just putting our money directly into a US Treasurey bond. In the case that the NPV is negative means that we could have made more money with a shorter investment or higher returns earlier. This reinforces the concept that time is money, and money today can be put work today so can be worth more than money that is in our pocket yet.

And there you have it, you're now well on your way to becoming rich beyond your wildest dreams. Or something like that.. At least you now know how to calculate investment value!

The rest of the math

To finish the formula..

NPV is the sum of all the present values

$$ {NPV = (PV_0 + PV_1 + PV_2 + .. + PV_t)} $$The present value is calcuated by looking at the Future value divided by the compounded interest

$$ {PV_t = \frac{R_t}{(1 + i)^t }} $$Therefore we can create a forumla that describes this as a sum

$$ {NPV = \frac{R_t}{(1 + i)^0} + \frac{R_t}{(1 + i)^1} + .. + \frac{R_t}{(1 + i)^t}} $$ $$ {NPV = \sum^n_{t=0} \frac{R_t}{(1 + i)^t }} $$NPV solvers

With the base understanding of how NPV works, I've created 2 variations of NPV calculators. The first created with HTML and Javascript can only calculate with a consistent future value return. The second one created in React with the help of my friend Jason can dynamically adjust for different future values of return.

References

- Investorpedia article by Jason Fernando Net Present Value (NPV): What It Means and Steps to Calculate It

- MathJax, a javascript engin for displaying math equations on your browser

- Photo by Scott Graham on Unsplash

- Codesandbox.io, a cloud development platform that empowers developers to code, collaborate and ship projects of any size from any device in record time.

- Net present value explained a youtube video created by The Finance Storyteller an amazing channel for explaining all things finance

- Also do checkout the rates for the US treasury bonds as a way to understand WACC @ Treasury Direct

- And special thanks for Jason for walking me through and helping me work on the React version of the solver.